As you know, a trading system consists of two components:

1. Trading strategy (TS) - the rules by which we enter, exit and / or follow the position.

2. Money management (MM) - risk management (assessing the risk per transaction, its increase or decrease when market conditions coincide).

📍 Toxicity (martingale, averaging, etc.) is an attempt to deceive the market, and shift all probabilities in your favor. It is not surprising that in inept hands, toxicity leads to the sudden death of the deposit.

It can be applied to both components of the system:

1. Toxicity applied to the TS: there are no stop-losses, the loss is waited out, when the price falls, the trader constantly opens counter trend transactions, waiting for a reversal.

2. Toxicity applied to MM: the risk per trade and leverage increase after a loss (martingale).

I would like to provide an alternative to the second scenario!

And it is called dynamic take profit:

INSTEAD OF INCREASING THE RISK ON A TRANSACTION, WE INCREASE THE AMOUNT OF TAKE PROFIT.

Lets take a look at this example, where TP is take profit, and SL is stop loss.

Martingale

TP is always equal to SL (let’s say, 100 points), but the risk increases after a loss:

1.TP = SL (100 p.). Risking of the 1% of the deposit. In case of loss, the result of the trade is negative 1%, in case of profit, the result of the trade is positive 1%.

2. TP = SL (100 p.). Risking 2% of the deposit. In case of loss, the result of the trade is negative 3%, in case of profit, the result of the trade is positive 1%.

3. TP = SL (100 p.). Risking 4% of the deposit. In case of loss, the result of the trade is negative 7%, in case of profit, the result of the trade is positive 1%.

4. TP = SL (100 p.). Risking 8% of the deposit. In case of loss, the result of the trade is negative 15 %, in case of profit, the result of the trade is positive 1%.

5. TP = SL (100 p.). Risking 16% of the deposit. In case of loss, the result of the trade is negative 31%, in case of profit, the result of the trade is positive 1%.

6. TP = SL (100 p.). Risking 32% of the deposit. In case of loss, the result of the trade is negative 61%, in case of profit, the result of the trade is positive 1%.

The total trading result: More than half of the deposit has been lost, there is nothing further to double.

Dynamic TP

Initially, TP is equal to SL (100 points), after a loss we, without changing the risk exposure, increase the value of take profit by 100 points:

1. TP = SL (100 p.). Risking of the 1% of the deposit. In case of loss, the result of the trade is negative 1%, in case of profit, the result of the trade is positive 1%.

2. TP = 200 p., SL = 100 p.Risking of the 1% of the deposit. In case of loss, the result of the trade is negative 2%, in case of profit, the result of the trade is positive 1%.

3. TP = 300 p., SL = 100 p. Risking of the 1% of the deposit. In case of loss, the result of the trade is negative 3%, in case of profit, the result of the trade is positive 1%.

4. TP = 400 p., SL = 100 p. Risking of the 1% of the deposit. In case of loss, the result of the trade is negative 4%, in case of profit, the result of the trade is positive 1%.

5. TP = 500 p., SL = 100 p. Risking of the 1% of the deposit. In case of loss, the result of the trade is negative 6%, in case of profit, the result of the trade is positive 1%.

6. TP = 600 p., SL = 100 p. Risking of the 1% of the deposit. In case of loss, the result of the trade is negative 6%, in case of profit, the result of the trade is positive 1%

The total trading results: the trading can still be continued, unlike the previous version with martingale. Total risk of a loss is only 6% of the deposit. The deposit is more alive than all living things and still feels great. In order to gain profit on the first trade, we did not double the risk exposure (which is a recipe for a deposit murder) on every step, but only "stacked" 100 points on top of our original TP, which was necessary to gain profit. Compare how much safer it is!

Now I use my backtesting platform to show everything on a yield chart:

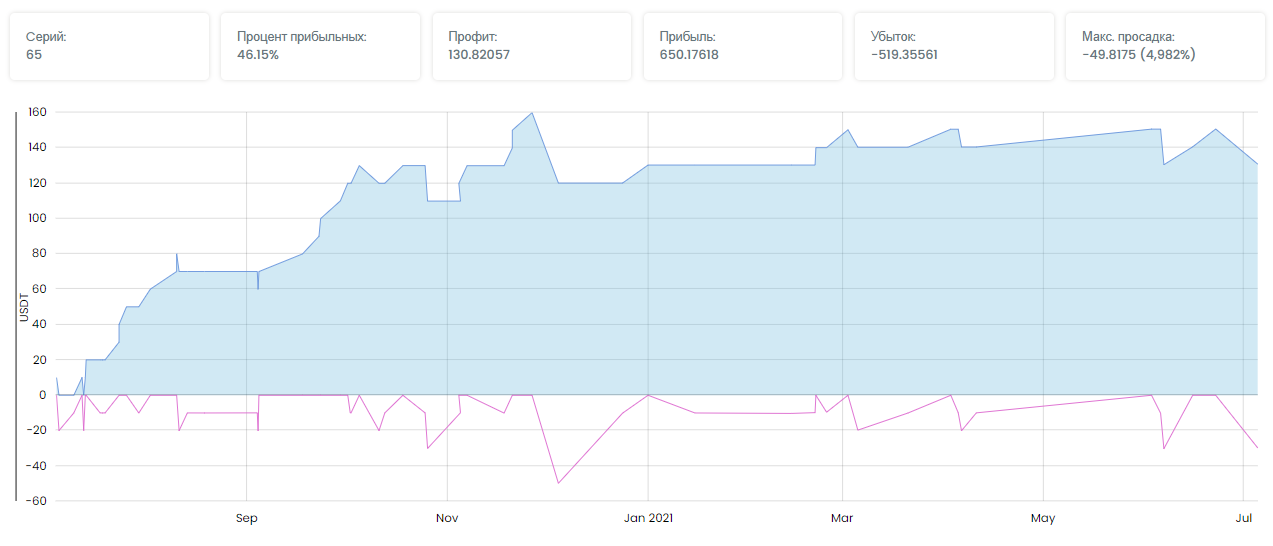

1. I input the parameters for trading without the techniques described above. To enter, I use the bare rules of my InFractals strategy.

It turns out something like this.

Profit $130 $, max drawdown $48. Already looking good! 😄

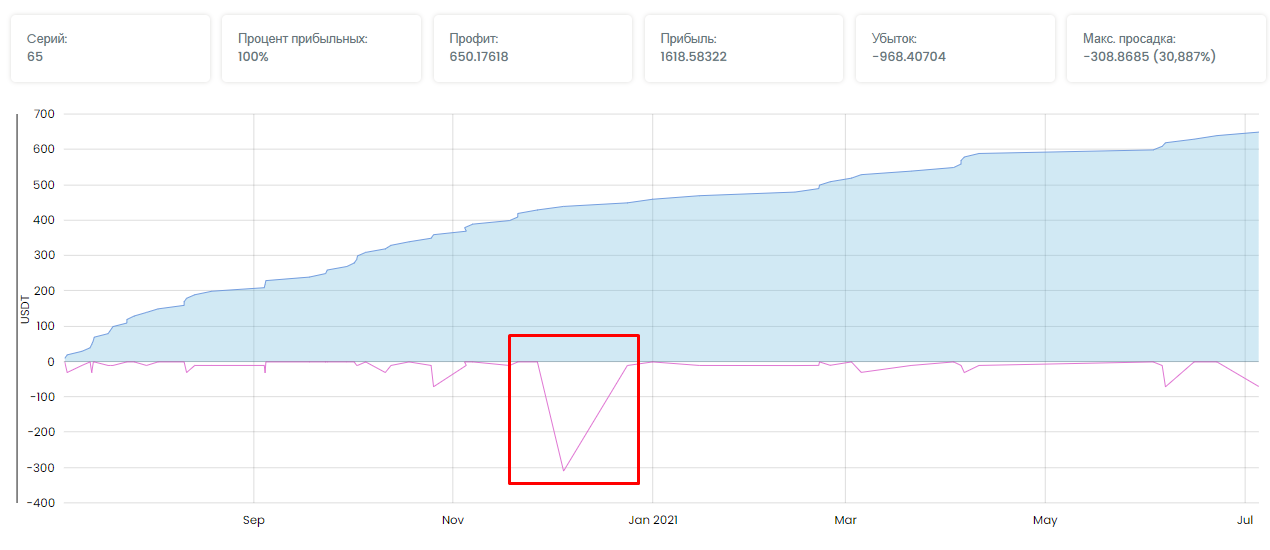

2. Let's apply martingale. The picture becomes more toxic (the nice looking yield chart, but at what cost!):

The profit increased to $ 650, the maximum drawdown at the moment (highlighted in red) reached -308 $! Even a $ 1000 deposit would withstand a maximum of one more doubling. If we needed one more step for Martingale, there would be no money left.

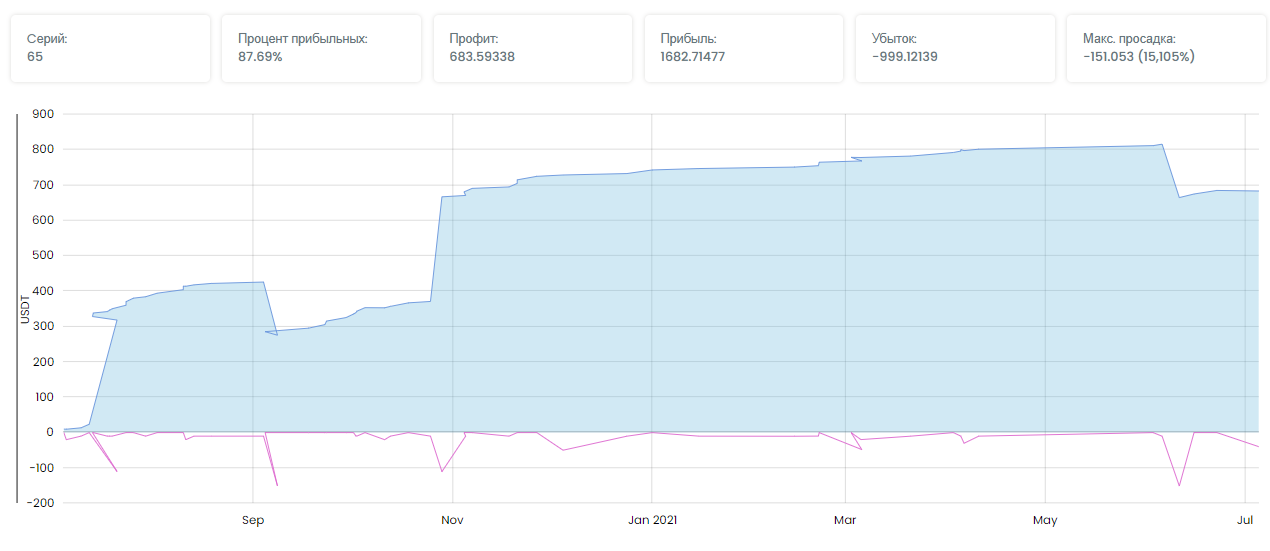

3. Apply dynamic take profit. We do not change the risk exposure, but TP after a loss will increase with a fixed step of 40%, or x1.4:

The chart became less elegant, but the profit was + $ 683 with a maximum drawdown of $151.

The dynamic TP earned even more than the martingale, the drawdown became twice as low, and we did not risk losing the deposit at all!

Verdict:

Of course, increased TPs are more difficult to take in the flat market. This approach is also not the Grail. However, it removes all the risks associated with martingale and offers a more elegant, efficient alternative to mindless toxicity. In the long term, the advantage is obvious.

Take a look at your strategy - would dynamic TP improve it? If so, be sure to run back tests (at least manually, with recording the results in Excel) - and off you go! 😎

Best regards, Ed Khan

Telegram: https://t.me/edkhan_cryptogallery