Financial markets are notorious for having very questionable and shady players. The cryptocurrency market is not an exception. To make huge financial gains, some dishonest traders use market manipulation mechanics called “Pump and Dump”.

What is the "Pump and Dump" scheme?

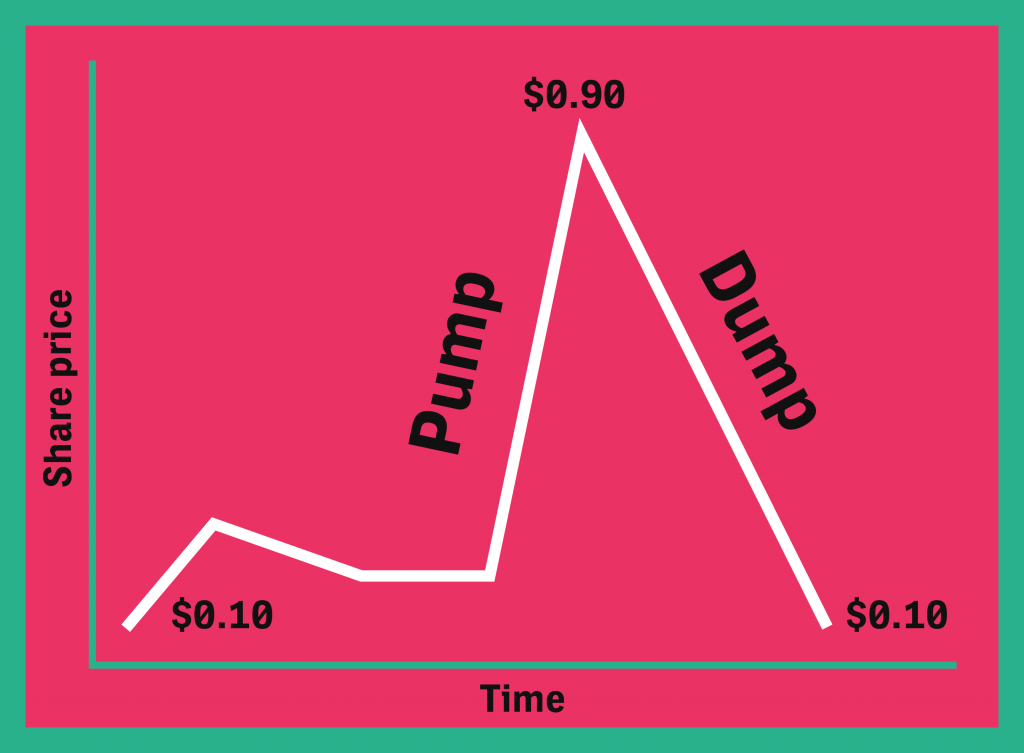

Pump and Dump is the artificial sudden and large increase of the market price of the asset (Pump), and then artificial price drop of the same asset (Dump).

The investors with a large amount of capital (whales) are usually the ones who initiate those schemes. These are the stages of the classic Pump and Dump:

1. Whales are purchasing an asset in large quantities at the current market price.

2. The price of the asset is driven up (Pump). There are many options to manipulate the prices.

3. Small traders and investors start to purchase an asset at a current highly inflated price.

4. Whales who started the whole scheme are selling (Dump) an asset in large quantities at the current highly inflated price.

This scheme was used way before cryptocurrencies came into existence. The first known case was recorded in the 18th century. The Southern Seas Company has artificially inflated the price of its own stock by promising investors super high returns, which was not possible and was never realized. This incident became known as the “Bubble of the Southern Sea”.

Another famous Pump & Dump took place right before the Great Depression. It was a conspiracy when some of the larger institutional investors traded some low-priced stock between each other inflating the price. Then the unreasonably highly-priced stock was sold to inexperienced investors. These market manipulations caused a severe crisis.

The "Pump and Dump" was used in many shapes and forms for many different markets. It took time for regulators finally to outlaw these manipulations and implement strict criminal punishment for those who orchestrate the Pump and Dump schemes.

Pump and Dump in Cryptocurrency

With the emergence of cryptocurrency, these manipulations became very popular in this new market. As a matter of fact, Pump & Dump is much easier to organize on the cryptocurrency market than on any other financial market.

These are the main reasons:

- No clear compliance and regulation;

- The inexperience of the crypto traders;

- A huge number of «junk» coins; AKA “Sh.tCoins”

- Ability to use social media and messengers to influence large groups of inexperienced online communities by dishonest market players.

It is so widespread, that it is impossible to even estimate the number of the incidents. The research by analytics of Royal College of London estimates a minimum of two Pump and Dump manipulations daily, with monthly total profits at $7 million.

This research does not take into consideration the incidents that span across few days or in some cases a few weeks or months. Those schemes involve higher investments from crooks, but profits are much higher as well.

Mechanics of the Pump & Dump in Cryptocurrency

The "Pump and Dump" is executed in few stages:

1. Choice of an Exchange – any exchange might be used for this purpose.

2. Choice of the crypto assets – depending on the budget the perpetrators choose the coin with correlated capitalization.

3. Gradual purchase of the large quantities of the coin, to make sure the price stays relatively stable.

4. «Pump» – perpetrator initiates the artificial price increase, by buying large quantities at once and simultaneously getting the large community of the small traders involved by creating the hype in the social media and messengers.

5. Second wave of “Pump”. This step requires a large budget from the perpetrators. They spend money to post and publish deceitful information on the well-known news channels, paying for the popular crypto influencers to promote the coin of the project or even famous experts. In this stage, the perpetrators do not buy any more coins. Instead, they just waiting for the right moment to start selling this coin.

6. “Dump”. When the manipulators feel that the price has picked on the back of the fake news and deceitful hype, they start selling this coin in very large quantities effectively dropping the price to very low levels.

Using this scheme crooks buy coins at the lower price and sell it at inflated value effectively making a great deal of profit. And small traders became Bag Holders (left holding the worthless coin).

The lifespan of the Pump and Dump scheme

All manipulation Pump and Dump will fall in one of those three categories, в based on their lifespan.

Short term

The first stage which is the purchase can last for several days, then several hours of "Pump" and a quick “Dump”. This scheme is used for coins with low capitalization. In this case, the scheme will cost perpetrators from several thousand to tens of thousands of dollars.

Medium-term

The purchase phase of these lifespan schemes can last up to several weeks. Then there is a sharp pump in price and several days of active sell-off where the price of the coin is plummeting. The cost of this manipulation is starting a few hundred thousand dollars, but sometimes it can reach a few million dollars. This scheme works well on relatively liquid coins.

Long term

For this type of scheme, perpetrators use the coin with capitalization from the top 100. Accordingly, the budget will range from tens to a few hundred million dollars. Such manipulations can last from several months to a year.

How to distinguish Pump and Dump

Those are the major signs of the Pump and Dump

- Increase of the trading value without price change

- Sudden price increase without any fundamental reasons;

- The price of the coin is different on different exchanges;

- Major hype of the project in social media and messengers without information incredible sources;

- The positive news after the price pump.

Those signs could be in any combination and have different degrees of intensity.

How to profit from Pump and Dump

In a short-term pump, only the perpetrators are making money. The small investors always end up as Bag Holders.

In medium-term schemes, even small investors can earn money if they bought a coin before it is pumped. As a member of interest groups in social networks and messengers, traders can be exposed to the information earlier than rest of the crowd (until the pumping stage is completed).

In long-term schemes, some of the small traders can also make a profit, and this is more probable than in the medium-term schemes.

But in any case, traders need to understand that this is a very risky scheme, the goal of which is that only the perpetrators make a profit, leaving the majority of the participants with losses. Therefore, it is important to have a very reliable source of information about the upcoming pumps.

The examples of the executed Pump and Dump schemes

There are many examples of such schemes been executed. But let's review some of the most notorious ones.

Yobit Exchange

One of the most daring cases of Pump & dump was orchestrated by a cryptocurrency exchange itself.

On October 11, 2018, the Yobit exchange posted a countdown timer on its website and announced on Twitter that in 22 hours it would start artificially pumping a randomly selected coin.

It was a short-term pump that was scheduled at the set time and lasted only a few minutes. It is difficult to estimate how many people made or lost money. But this case demonstrates that there is no ethical conduct exercised by the crypto exchange.

The lack of regulation played a big role here. And also the fact that the exchange itself could have committed fraud by making up and posting any coin value that is most likely not even a real price is mind-boggling.

ParallelCoin

This case is a memorable one since the Pump was totally out of proportion so was the Dump.

On November 5, 2019, the price of the ParallelCoin coin went literally to the Moon and back crashing down to the Earth. The price from $1.60 reached $2200 in a matter of a few hours. That is more than a 1000X increase. Immatures then began actively promoting this project calling it an emergence of a new bitcoin. But after a few hours, the value just crashed back to around $2.

LINK

This is a medium-term pump, is notorious because of the involvement of some very large projects.

- On June 13, 2019, Chainlink announced its partnership with Google Cloud on its Twitter page. And this information was confirmed. The LINK token price then rose from $ 1.17 to $ 1.95.

- At the end of the same month, the token was listed on the Coinbase exchange, and its price has reached $2.31.

- A couple of days later, the artificial pumping has begun, and the price of LINK increased to $4.55.

- During this manipulation, the daily trading volume for the LINK token reached a huge level of $863 million with a total capitalization of only $1.4 billion.

- A few days later, the dump began - the token price has dropped to $3.71.

- After another 2 weeks, the price has dropped to $2.77.

- A month later (in September) LINK was valued at $1.59.

In terms of life span, this can be considered a medium-term scheme. But in terms of the invested funds, it was comparable to the long-term.

E-Coin

This is a classic example of how several stages of junk coin manipulations in the Pump & Dump scheme:

- On February 6, 2018, the price of the ECN token increased from $5 to $300 (60 times). At the same time, it broke into the Top 20 coins with a capitalization of $1.5 billion.

- Then, within a few days, the rate dropped to $50.

- By the end of the second stage of the pump, the token price toped at $230.

- Then there was an even sharper price fall - to the $7 level.

- By the end of the third pump, the coin value was pumped to $70.

- From there, the price start its gradual decline and was never pumped again.

What really amazing, that during these events, the E-Coin company did not even have an operational website. This indicates that the price swings were artificially created without any fundamental factors.

Conclusion

Unfortunately, in today's cryptocurrency market Pump and Dump schemes are an integral part of it. Sometimes large companies and even crypto exchanges themselves are involved in this shady activity. The lack of regulatory overseeing, as well as the low capitalization of many coins, are the contributing factors to the manipulative unjustified price swings. It is wise for all honest traders to stay away from those schemes and always DYOR (do your own research) since the risk of losing hard-earned crypto in Pumps & Dumps is unreasonably high.

Telegram: https://t.me/deeptrd

Trade: https://app.aivia.io/ranking/136?a=VA9GZqD97a